The CCP Is Inside the Fed: Shocking New Evidence of Chinese Infiltration at America’s Central Bank

A decade-long infiltration campaign by the Chinese Communist Party has penetrated the Federal Reserve—coercing employees, stealing sensitive data, and compromising America’s financial core.

Most Americans have heard about Chinese spies targeting our military or hacking private companies. But there’s another front in this quiet war, one that’s gone largely unreported—and it may be the most dangerous of all: China’s long game to infiltrate and manipulate the United States Federal Reserve.

A 2022 Senate investigation offered a rare glimpse into this operation, but even that barely scratches the surface. What’s playing out behind closed doors isn’t just a few bureaucratic missteps or naïve collaborations—it’s a full-blown economic espionage campaign.

This is warfare without bullets.

The Fed: A Prime Target for Chinese Espionage

The Federal Reserve is the engine of the U.S. economy. Its decisions move markets, shape global capital flows, and set the tone for the world’s monetary system. Infiltrating the Fed doesn’t just give China intelligence - it gives them influence.

Over at least a decade, the CCP has targeted Fed employees through a mix of coercion, recruitment offers, unauthorized data access, and propaganda partnerships, mostly hidden behind Chinese academic institutions and think tanks.

According to this damning Senate report, the Fed’s own counterintelligence team identified a group of 13 employees across eight regional banks—internally referred to as the “P-Network”—who exhibited serious red flags linked to the Chinese government.

This pattern could be replicated at scale.

Hard Evidence of Espionage and Infiltration

Here are some documented examples that received little attention from the mainstream media:

1. Detained and Surveilled in China (Individual A)

• In 2019, a Fed employee was detained four separate times by Chinese authorities during a visit to Shanghai. He was threatened, told his family would be harmed, and coerced into handing over sensitive U.S. economic data. Chinese agents accessed his Fed laptop, phones, and internal contact lists. He was ordered to “tell a good story about China” back in the U.S. This employee returned to his post with full access to confidential monetary policy data.

2. Secret Data Transfers to Chinese Institutions (Individual B)

• Another employee sent modeling code and restricted Fed data to a university linked to China’s central bank (PBOC). He proposed deeper collaboration between his Reserve Bank and Chinese state institutions while maintaining access to Class II FOMC data, which includes sensitive internal forecasts and deliberations.

3. Coordination with Chinese Propaganda Outlets (Individual C)

• Another Fed employee took a paid visiting professorship in China funded by the CCP and subsequently acted as a liaison with Xinhua News Agency, the Chinese government’s propaganda arm. He even helped Chinese journalists and officials gain access to Fed contacts, often bypassing formal Fed communication channels.

4. Suspicious Talent Recruitment Programs (Individual D)

• Another Fed employee attempted to transfer large U.S. data sets to Chinese institutions. He was found to have joined the Thousand Talents Program, China’s premier foreign recruitment tool for stealing scientific and economic research. This affiliation was never disclosed and the employee continued working at the Fed.

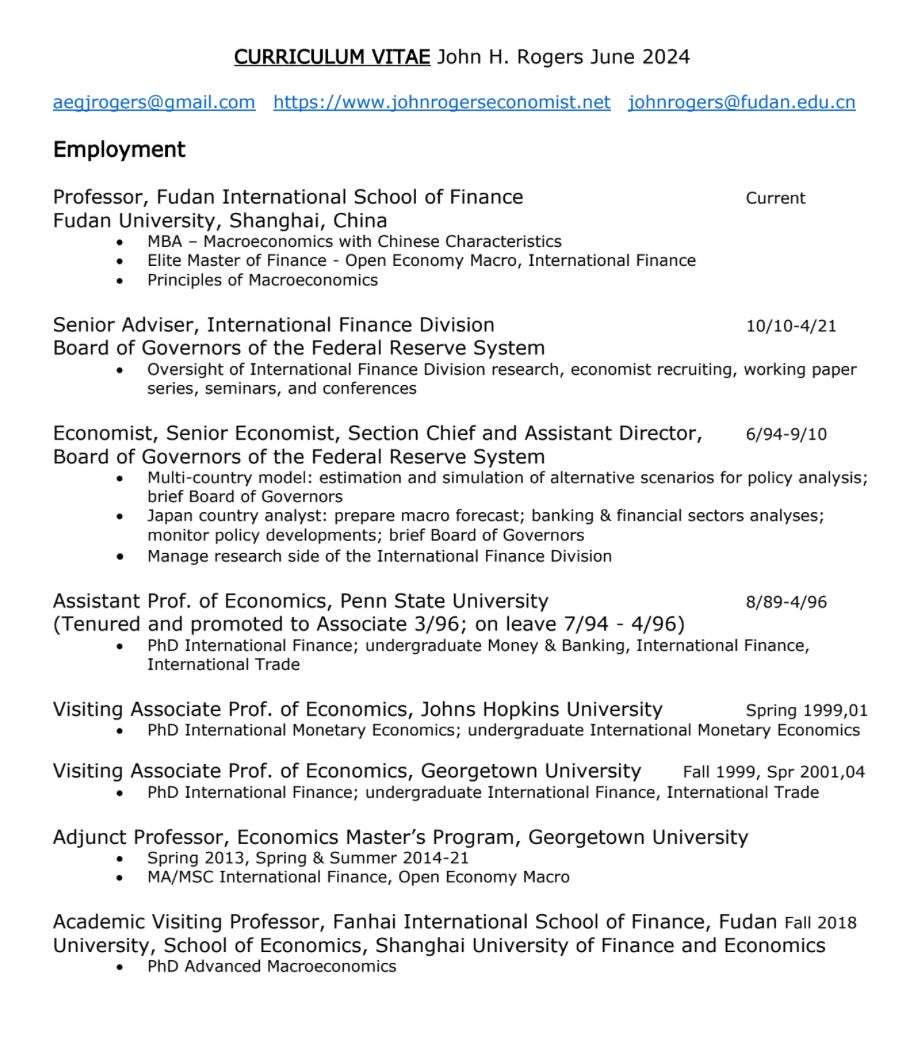

A Named Case: John Harold Rogers

The Justice Department indicted John Harold Rogers, a former senior adviser in the Federal Reserve’s Division of International Finance, for allegedly passing sensitive U.S. economic data to agents tied to the Chinese government .

Rogers served at the Fed from 2010 to 2021, holding access to confidential materials related to FOMC deliberations, economic forecasts, and tariff policy analysis .

He allegedly began working with Chinese co‑conspirators posing as university students starting around 2013, and intensified the misconduct after 2018, using personal email and printed documents to transfer restricted Fed data .

In 2023, Rogers is accused of receiving approximately $450,000 from a Chinese university while teaching and meeting with these supposed “students” in China, including hotel rooms where he shared Fed trade secrets.

I can exclusively reveal Rogers’s even deeper ties to the CCP, as revealed throughout his resume.

He delivered an address – “The New Paradigm and New Macroeconomy” - at the China International Capital Corporation (CICC) Investment Strategy Conference on June 12th 2024. CICC is a Chinese partially state-owned multinational investment management and financial services company. He also spoke at the Western China International Finance Summit in 2023.

Additionally, he’s spoken at CCP-owned universities including Peking, Tsinghua, and the Shanghai University of Finance and Economics.

His resume also includes countless works of academic research on topics including “The Effect of the China Connect”; “Crossing the Renminbi Rubicon: The Implications of China's Policy Challenges and Capital Flows”; “U.S. China Tensions” and “Visible Hands: Professional Asset Managers’ Expectations and the Stock Market in China.”

Former Fed Governor Frederic Mishkin also received an honorary professorship from Renmin—China’s top state-run economics university.

Academia: The Trojan Horse of CCP Influence

Federal Reserve economists are coauthoring research with Chinese universities—many directly tied to the CCP and its economic warfare apparatus.

These aren’t innocent academic projects; they’re strategic intel-gathering operations. Every shared model, dataset, or forecast gives Beijing deeper insight into how the Fed thinks and moves.

Let’s call it what it is: infiltration disguised as scholarship.

Now-indicted John Rogers, for example, has a robust history of co-authoring research papers with individuals from CCP-run institutions. Examples include “Forward-Looking Monetary Policy and the Transmission of Conventional Monetary Policy Shocks” alongside Wenbin Wu of Fudan University.

A previously unreported form of influence also comes from the involvement of CCP-linked individuals actively working on research papers aimed at guiding the Fed on a variety of issues including China.

During the Finance and Economics Discussion Series at the Fed in 2020, for example, the paper mentioned above was circulated to influence discussion surrounding variables used in projections.

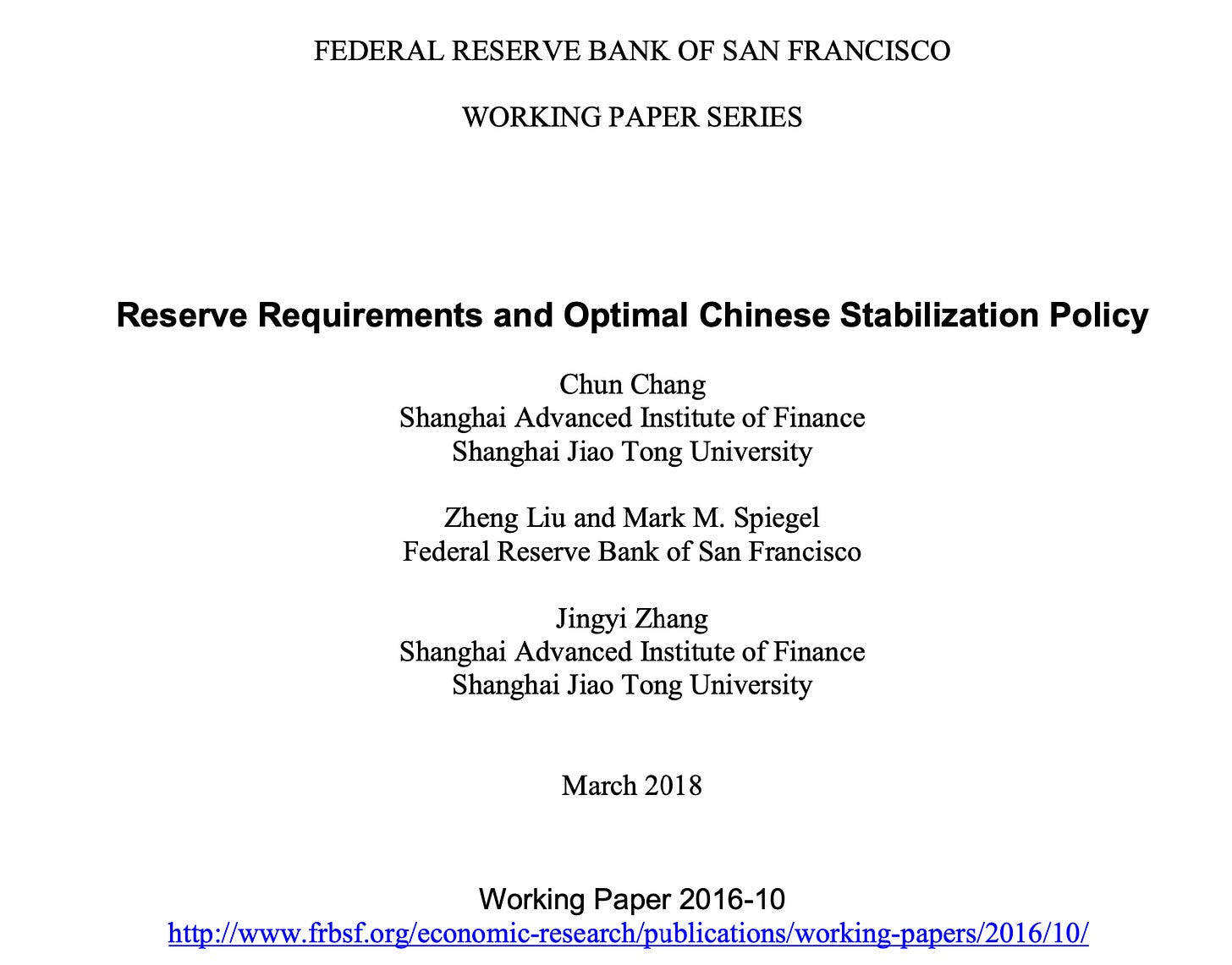

The paper “Reserve Requirements and Optimal Chinese Stabilization Policy” from the San Francisco Fed features two Fed employees in addition to researchers from Shanghai Jiao Tong University. This university has been caught engaging in both direct espionage and attempting to subvert Americans into leaking classified documents.

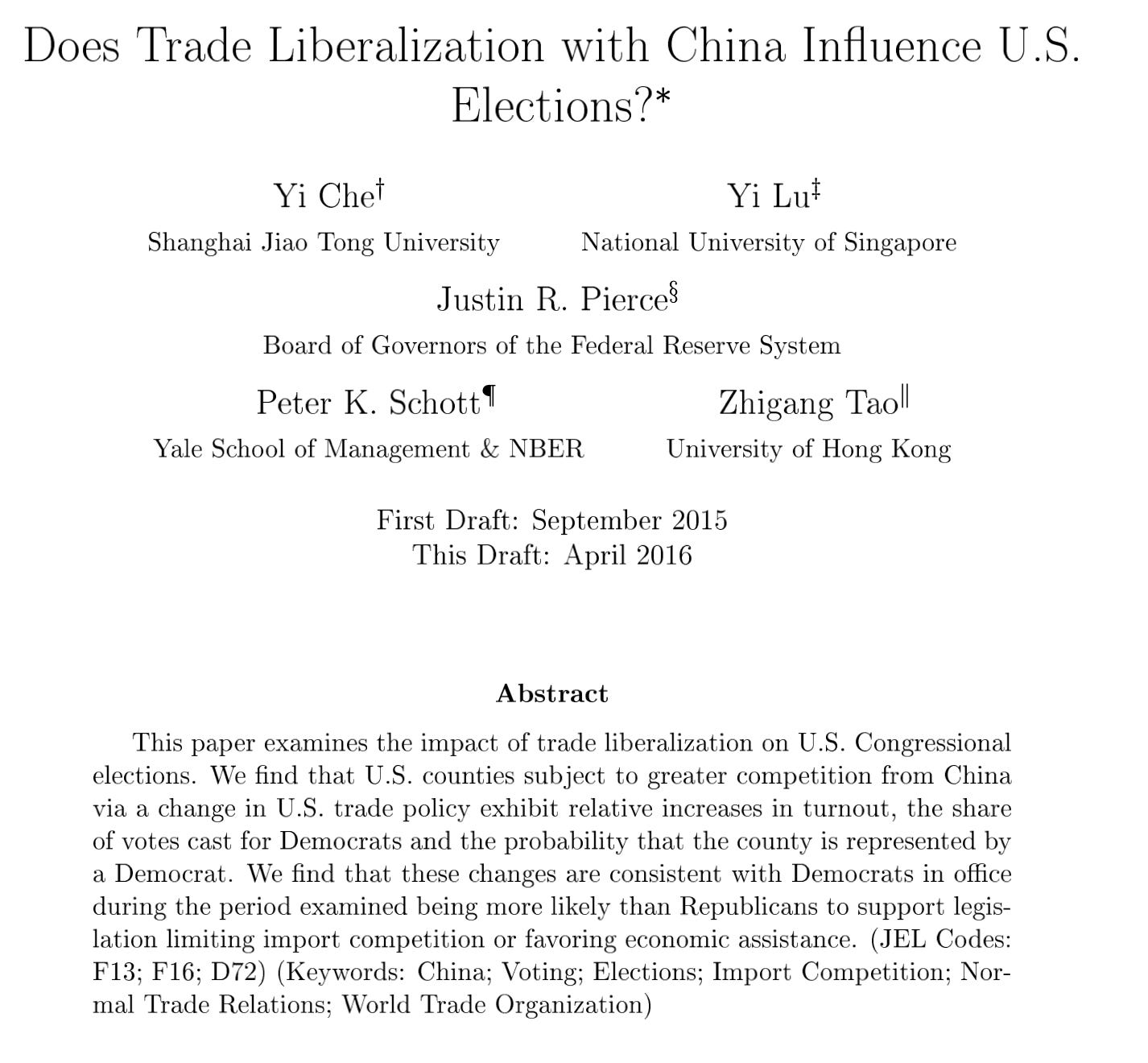

No issue appears off limits, as a 2016 paper entitled “Does Trade Liberalization with China Influence U.S. Elections?” featured Justin R. Pierce, a member of the Board of Governors of the Fed, and Yi Che of the controversial Shanghai Jiao Tong University.

“This paper examines the impact of trade liberalization on U.S. Congressional elections,” begins the paper’s abstract.

Feng Dong and Yi Wen, of Shanghai Jiao Tong University and the St. Louis Fed, respectively, published “Flight to What? Dissecting Liquidity Shortages in the Financial Crisis ” concluding a “sharp reduction in the quality, instead of the liquidity, of private assets was the culprit of the recent financial crisis.”

“In particular, too much intervention for too long can depress capital investment,” they continued.

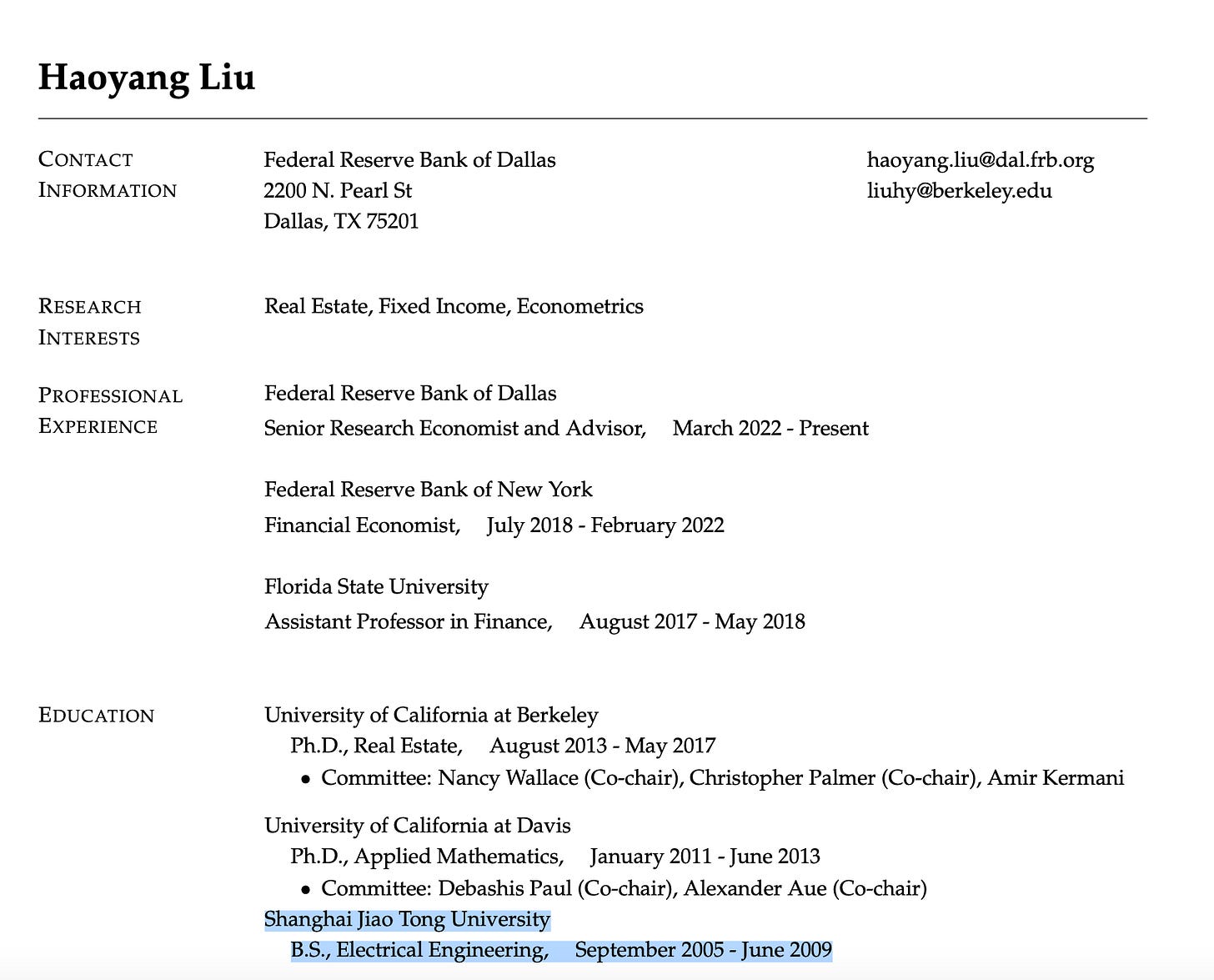

Even a cursory search of publicly available resumes for Fed employees reveals individuals like Haoyang Liu, formerly at the Federal Reserve Bank of New York and now at the Dallas equivalent for having been educated at Shanghai Jiao Tong University. This was one of the universities singled out by the Senate report for targeting American Fed employees with espionage offers.

These affiliations may appear harmless, but the Senate report empirically shows they are exactly the kinds of connections China uses to gain influence and extract sensitive insights.

Under Powell: A Leadership Failure of Historic Proportions

Though some CCP activities predate Fed Chair Jerome Powell’s tenure, the threat deepened dramatically under him.

Despite receiving internal reports of attempted data thefts, coercion, and foreign recruitment, Powell’s team allowed the implicated employees to keep working with minimal restrictions.

The Fed also expanded international research collaborations without tightening security—leaving the door wide open. Powell did not mandate disclosure of foreign academic affiliations or payments, even from known adversary nations.

The only meaningful policy change came after the Senate launched its investigation, banning compensation from “countries of concern”—but still allowing Chinese affiliations if unpaid.

The Big Picture: Economic Sabotage

This isn’t just academic misjudgment. It’s economic warfare.

The Chinese Communist Party has made clear its goal is to replace the U.S. dollar with the yuan, dominate global finance, and sideline America from the world stage. Infiltrating the Fed gives them access to internal rate forecasts before public release, insights into inflation expectations, stress tests, and market interventions, and influence over who the Fed talks to—and how.

This is not just a scandal—it’s a national emergency. The CCP is already inside the house. If we don’t act, we’re handing them the keys to the global financial system—and walking away.

Like this piece? Share it. Subscribe. And stay vigilant. Because this is the kind of story the mainstream media won’t touch—but you need to know.

Using Powell as a measuring example, what is the practical difference between a fool and a traitor here?

sooo, when do the indictments start?